New guide for linking sovereign debt to climate and nature action

During this 'super year', the world is focusing on international summits aiming to tackle global crises of climate change and biodiversity loss. But a third crisis is looming: debt. A new practical 'how-to' guide for innovative debt instruments helps support developing countries tackle the triple crisis of debt, climate and nature.

Diema community in Keyas region, Ethiopia (Photo: WFP/Rein Skullerud via Flickr, CC BY-NC-ND 2.0)

Rising debt-to-GDP ratios are hitting developing countries’ ability to access markets and finance, limiting their options for future action. If this increased debt coincides with a prolonged period of low economic growth post-COVID-19 and rising global interest rates, the debt crisis will worsen further.

The international community knows it needs to act, not only on debt, but also to mobilise funds for urgent investment in climate change mitigation and adaptation and to protect nature. But so far, international initiatives have had limited impact and climate finance remains limited.

Solutions to the debt spiral need to address the causes of ongoing debt problems, not just offer a brief suspension of debt repayments. It is time to find an operational route out of this debt, climate and nature crisis.

How-to guide for sovereign debt linked to climate and nature outcomes: seven steps

To address this situation, IIED, Potomac Group and United Nations partners have published a new 'how-to' guide providing governments with an actionable plan for using new debt instruments designed to create fiscal space and achieve climate and nature outcomes.

Experience with these new instruments is still emerging and needs to be based on the country context, and the guide will be revised in six months based on the latest evidence.

The guide breaks down the process of executing debt transactions for climate and nature into seven straightforward steps. These are:

- Create an inter-ministerial taskforce and agree on national objectives

- Access capacity building and advice

- Choose type of sovereign debt transaction: debt conversion or new instrument

- Structure climate and nature key performance indicators (KPIs) or other relevant performance criteria

- Design financing aspects of the transaction

- Take market soundings with creditors, credit rating agencies, and investors, and

- Execute debt transaction.

The guide is directed at ministries of finance but will also be useful for ministries of environment and other ministries linked to climate and environment, such as agriculture, energy and fisheries.

It is a practical map for other involved parties, including creditors, international institutions and nongovernmental organisations providing external advice and support. We have also issued an associated policy briefing to introduce the seven-step framework to least developed countries (LDCs) policymakers.

How does linking debt with climate and nature action work?

Debt instruments linked to climate and nature action can be a vital part of a coherent response to the triple crisis of debt, climate and nature. The approach involves restructuring debt to improve a country’s overall fiscal space – its capacity to use financial resources to address budgetary priorities.

To restructure a debt, a creditor and a debtor agree to convert the debt in some way, for example, via a change in the terms, or by buying the debt at a cheaper rate on the secondary market, or by supporting conversion to a different financial vehicle.

Such debt instruments can deliver extra finance for climate and nature by redirecting the funds the debtor would have had to pay back for debt servicing or by adding additional flows through issuing a new bond. These transactions can be scaled up through payment into a government’s own budget to have a major impact on debt and climate and nature.

The debt payments are results-based, linked to climate and nature KPIs drawn from the debtor government's existing commitments, such as costed Nationally Determined Contributions (NDCs) for climate or National Biodiversity Strategies and Action Plans for nature.

Debtor nations can use the finance generated through these ‘general purpose’ debt instruments to address a range of fiscal priorities – for example, funding for health spending. Debtors will also need to spend some funds on achieving the climate and nature KPIs, against which creditors and investors will make their results-based payments

LDCs should lead wider international efforts

This framework is part of a wider effort by the international community to address the triple threat of rising debt levels, climate change and nature loss. The World Bank, International Monetary Fund (IMF), United Nations and the OECD are currently developing a platform to link debt to climate and nature. Developing countries, particularly LDCs, need to engage with the new platform and ensure it supports their needs.

At the same time, developing countries, particularly LDCs, can collectively call on the international community to support an international debt-climate-nature initiative that benefits them and advocate for collective negotiations on debt with creditors.

What's next?

The next step is to roll out and pilot this framework and 'how-to' guide. United Nations Economic Commission for Africa (UNECA) and other UN regional commissions and the United Nations Development Programme (UNDP), working with the IMF, World Bank and regional development banks, such as the African Development Bank, can pilot this framework in a number of countries with technical support from organisations such as IIED and others.

Overall, the benefits of linking debt to climate and nature action go far beyond short-term balance sheet management. This approach can help to streamline non-concessional development finance so that debt stays affordable and ensure that the finance has a meaningful, measurable impact on climate and nature for borrowing countries.

Our 'how-to' guide was prepared during the COVID-19 pandemic, but the seven-step framework should endure well beyond the current crisis. This approach could represent a permanent transformation of the global financial architecture to address the triple crisis of debt, climate and nature.

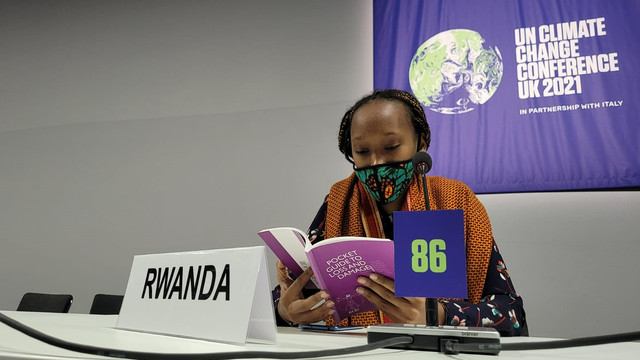

The 'how-to' guide will be launched at a session on Tuesday, 9 November at 2.30-4pm under the 'financing a resilient future' theme at this year's Development and Climate Days 2021 during COP26.

- Download 'Linking sovereign debt to climate and nature outcomes. A guide for debt managers and environmental decision makers'

- Register for D&C Days 2021 and join grassroots representatives, researchers, development practitioners and policymakers from all over the world discuss how to build a climate-resilient future for all